Case Study: Aggregating $1.5 Billion Under a Financially-Engineered Family Office Consortium

Tuesday I alluded to utilizing the highest levels of financial engineering to control the frame with institutional allocators.

Today, I’ll cover a specific example of how our financial engineering expertise affords us entirely different positioning with respect to family offices than what other capital seekers experience. Our expertise and positioning allowed us to build a de novo structure that became a magnet for $1.5 billion of family office capital, and we only seeded it with $15 million.

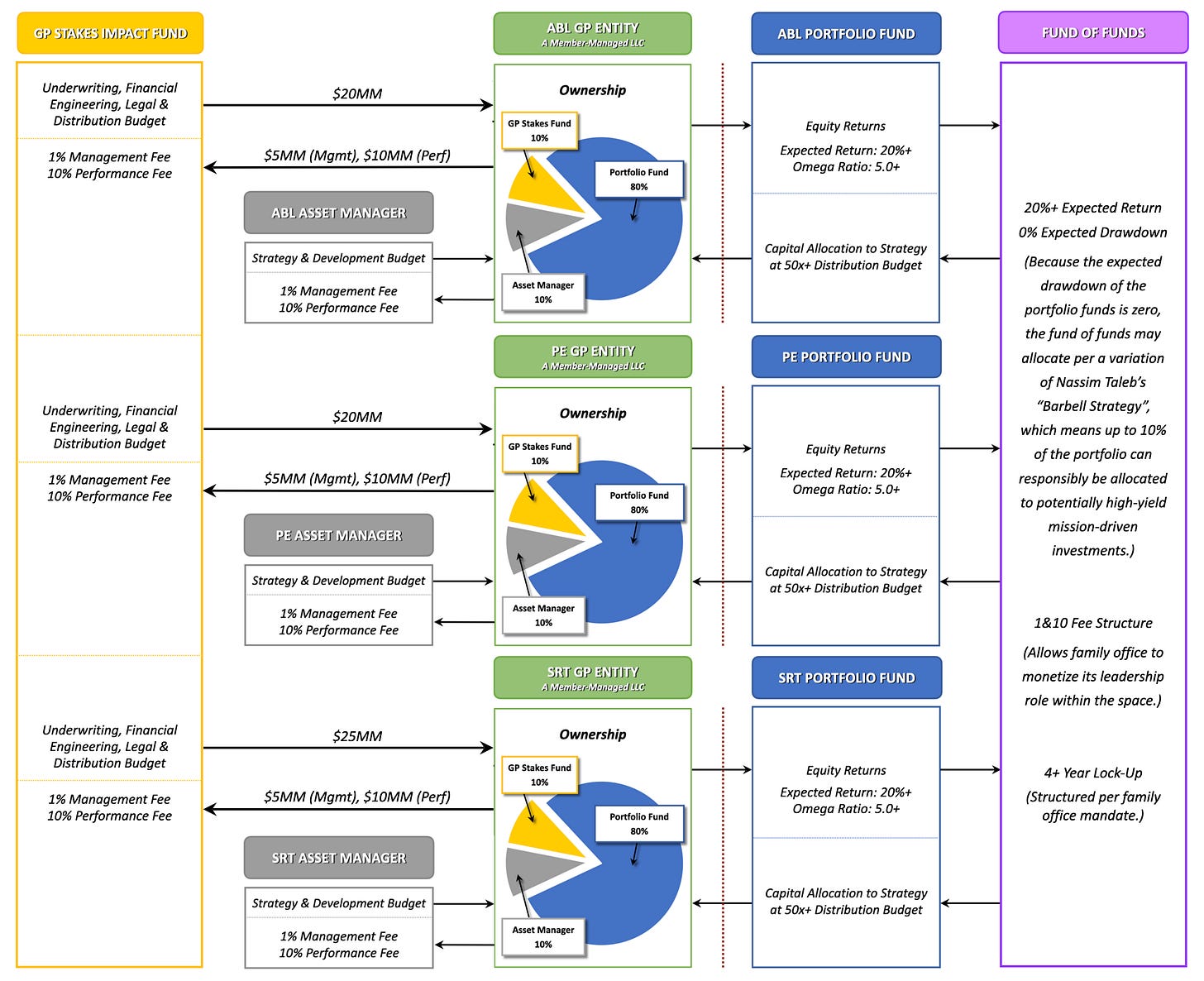

How? We engineered performance and terms that were far better than any of the participating family offices could get anywhere else, and we did so without diluting ourselves. The structure is comprised of:

a GP stakes fund

three alternative asset managers

three private structured products (with the flexibility to issue fixed income or equity), and

a fund of funds.

We recruited a sophisticated anchor family office via a mutual relationship within the private equity space. The family office was tasked with recruiting four additional family offices that shared mutual respect to create a “Skull and Bones” of thought leadership within the space: a consortium of five family offices (the “Consortium”).

We built a dedicated GP stakes fund for the Consortium with a $65 million dollar soft cap. We allocated $15 million and each of the five family offices were made responsible for allocating $10 million. In addition to the $10 million dollar allocation, each family office agreed to be responsible for raising a minimum of $300 million into the other end of the structure—either into the fund of funds, or in rare cases, directly into the portfolio funds.

Why would a family office agree to invest $10 million as an LP into a de novo fund with an obligation to bring another $300 million into a different de novo fund?

The unique structure of this GP stakes fund affords its LPs approximately half the fee structure of alternative asset managers whose strategies have been underwritten to generate 20%+ annual returns with extremely low risk as measured across a minimum of one complete market cycle. (To learn more about the latest developments in the mathematics of risk measurement, read my technical paper on the subject.) GP stakes fund LPs are also afforded a share of the fees at the fund of funds level.

For those who aren’t familiar with fund fee structure, fund managers usually get paid an annual management fee, which is typically 1%-2% of the total value of the fund, in addition to a performance fee, which is typically 10%-30% of the fund’s annual gains.(While all the components of a traditional fund are deconstructed and rearranged within the structure we designed, the principle still holds.)

So when the family offices of the Consortium pick up the phone and use their influence (which we enhance with our quantitative finance expertise) to recruit $1.5 billion of AUM into the structure, they are immediately rewarded with an approximate $15 million dollar return via their share of management fees against the $65 million invested into the GP stakes fund, which breaks down to approximately a 23% return. In other words, they dictate their own performance simply by exercising their existing influence.

At the end of each fiscal year, the GP stakes fund earns another $30 million in performance fees from the alternative asset managers wrapped within the structure, which is another 46% return.

That’s a 69% annual return on the Consortium’s investment, of which 23% is effectively guaranteed by virtue of the AUM they recruited into the structure. The more AUM they bring in over and above the obligatory $1.5 billion, the higher their returns grow.

What gives the Consortium confidence in recruiting the $1.5 billion into the structure?

First, nothing moves family office money like other family offices—especially highly respected family offices—but that’s not enough.

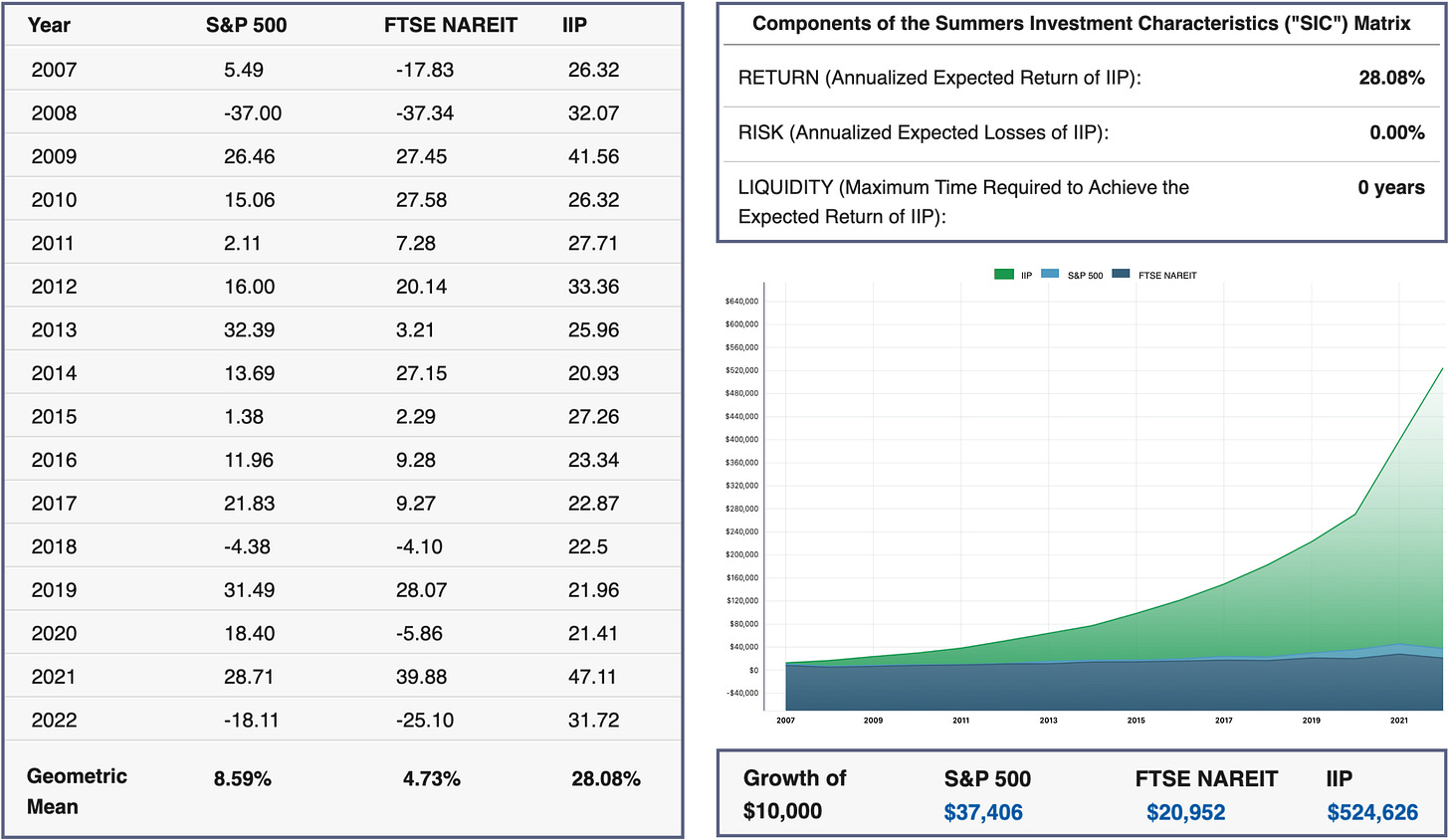

I mentioned that we enhance the Consortium’s thought leadership position with our quantitative finance expertise. Here’s what I mean: we are one of only a handful of firms in the world that is able to accurately and discretely measure risk in the exact same manner casinos understand the risks associated with their games. (This mathematics was developed for infinitely variant systems only as recently as 2014. If you’d like to learn the methodology, you can read my technical paper on the subject.)

But the impetus behind the Consortium’s increased status and influence is much more than just esoteric math... We applied that math to identify, optimize, and incorporate three asset managers into the structure that each generate an expected 20%+ annual return as measured since January 2007, or earlier, and have experienced approximately zero drawdown over that same period.

The only access to this performance outside of the GP stakes fund (with rare exceptions) is through an exclusive fund of funds, and the Consortium stands as its gatekeeper. With our support, the Consortium has leveraged its legacy esteem into a formal pentarchy within the family office space. Here’s a high-level overview of the structure:

THE GP STAKES FUND

The GP stakes fund leverages Adagio’s expertise and capital partners to acquire and efficiently scale positions with sponsored asset managers that allow for unparalleled returns with minimal downside exposure.

The GP stakes fund generates yield by sharing management and performance fees with three alternative asset managers through the portfolio fund created for each: asset based lending (“ABL”), private equity (“PE”), and synthetic risk transfer (“SRT”).

GP stakes fund LPs are responsible for driving $1.5 billion of AUM into the fund of funds, which allocates exclusively to the portfolio funds and immediately generates management fees.

Asset managers provide their esoteric expertise, time, strategy, investment and other resources representing 61% of the structure’s value relative to the GP stakes fund’s capital contribution, but the GP stakes fund is afforded approximately half the asset managers’ de facto fund-level compensation (actually paid at the GP entity level), representing a 22% discount to the position’s mark-to-market value. In addition to the gains generated from management and performance fees, the value of the GP stakes fund’s positions themselves increase exponentially as the Consortium drives AUM into the structure.

THE ASSET MANAGERS

Inefficiencies in private asset markets create unique arbitrage opportunities unavailable within their public counterparts.

The buy side of our firm is dedicated to identifying and recruiting the rare undercapitalized alternative asset managers that are able to systematically capitalize on such arbitrage opportunities. We apply a supportive structural and operational overlay to ensure these private market arbitrage strategies are managed to institutional standards. The result is objectively better risk-adjusted performance than what’s otherwise available through traditional capital markets as measured across a minimum of one complete market cycle (i.e., January 2007 or earlier) taking into account all four statistical moments of risk: mean, variance, skewness, and kurtosis. Finally, we optimize the asset managers’ strategies and strategically aggregate them into portfolios that achieve unmatched risk-adjusted performance at scale.

In the instances where asset managers’ performance history does not extend to January 2007, we construct theoretical track records that encompasses a complete market cycle by rigorously accounting for every measurable variable that contributes to the overall performance of their strategy. This process can be thought of as a pro forma in retrospect. The asset manager’s strategy is converted into a comprehensive set of rules with actual historical data (starting in 2007 or earlier) being plugged into the model as opposed to guesses about the future. This methodology does not allow for cherry picking or data fitting.

Once the asset managers’ strategies have been measured and optimized, we further optimize their capital structure and integrate them into the overall structure. They run their optimized strategy and operations under the supervision of the GP stakes fund via the GP entity.

The asset managers under this family office structure represent innovative asset-based lending in real estate, value-add healthcare private equity, and synthetic risk transfer; their performance is aggregated below under the discussion of the fund of funds.

We’re continuously searching for asset managers that are able to generate competitive performance to add into this structure and others like it.

THE PORTFOLIO FUNDS

The portfolio funds are private structured products that are engineered to bridge the gap between the terms asset managers would naturally issue and actual capital market demand.

Typically an asset manager will defer to their securities counsel with respect to how their fund should be structured. Attorneys are not financial engineers, and the result is that each asset class has conformed to its own boilerplate fund structure that does not take into account capital market demand for performance: hedge funds issue common equity with a 2 and 20 fee structure (or some slight variation thereof); real estate private equity is a closed end fund offering a preferred return with a catch-up, waterfall, and carry; etc.

We engineer the portfolio funds to issue equity or fixed income with a volatility buffer/insurance wrapper to effectively guarantee the performance of the fixed income class against conditions commensurate with 2008-2010.

The lock-up period of each fund is determined by how much time is required to achieve the expected return under the absolute worst cast scenario.

THE GP ENTITY

The GP entity houses the strategy of each asset manager and receives a 2% management fee and 20% performance fee (2 and 20). Underlying assets may be contained within dedicated special purpose vehicles (SPVs).

The management fee is paid to the GP entity upfront (i.e., as capital contributions are made and on every anniversary thereafter); the performance fee accrues at the end of each fiscal year and may be realized as liquidity events occur at the fundamental asset level.

Performance net of the 2 and 20 is owned by the portfolio funds, which represent the $1.5 billion of AUM raised by the Consortium and allocated through the fund of funds. Half of the 2 and 20 (1 and 10) is owned by the GP stakes fund.

$30 million of the $65 million investment by the GP stakes fund is reserved for distribution budget for the fund of funds to supplement the $1.5 billion AUM mandate imposed on the Consortium.

GP stakes ROI calculation based upon our historical cost of raising capital ($29,798,000 distribution budget is rounded up to $30 million to simplify the calculations):

Fund of funds cost of capital = 2% (e.g., $30 million distribution budget yields $1.5 billion AUM)

1% management fee against $1.5 billion AUM = $15 million to GP stakes Fund

Expected annual returns of strategy = 20% (20% x $1.5 billion = $300 million strategy returns)

10% performance fee against $300 million strategy returns = $30 million to GP stakes fund

1% management fee of $15 million + 10% performance fee of $30 million = $45 million to GP stakes fund

$45 million / $65 million total GP stakes fund investment = 69.23% return

THE FUND OF FUNDS

Funds of fund are not very popular investment vehicles within the institutional space—especially amongst family offices, but the fund of funds we designed is the exclusive conduit to the highly coveted investment performance and analysis we provided the Consortium. The fund of funds can be renamed, duplicated and ostensibly restructured to meet specific immutable allocator biases as necessary. In rare instances, if all feeder structures are a nonstarter, allocators can invest directly in the portfolio funds, if warranted.

The minimum lock-up period of the fund of funds corresponds to the lock-up period of the constituent portfolio funds, although family offices generally manage patient capital, which allows for fund of funds with lock-up periods that far extend the minimum requirement given the liquidity characteristics of the portfolio funds. In this case, the lock-up period is ten years.

We also create funds of funds as part of structures like this for RIAs allowing retail investors (e.g., high-net-worth professionals) access to this institutional level of performance. For retail advisors and their clients, the fund of funds serves as a single packaged product that replaces the entire alternatives portfolio. Retail-facing funds of funds we design most commonly have a lock-up period of four years.

THE IMPACT OF OUR WORK

While the impact of our expertise on generating this performance can’t be overstated, the arguably greater contributing factor is the level of effort we make. We do what no one else is willing to do in every facet of the process—from academic research to implementation and execution. If something can be known, we make every effort to know it, and if anything can be done to improve outcomes, we do it. Nothing is ever “good enough”. We can’t compete with Blackstone on brand recognition, but we can and we win on expertise and performance.

University finance departments look to us for improved methods of measuring and optimizing investment performance to inform their curricula, and the institutional space looks to us to implement it.

HOW CAN YOU BENEFIT?

If you’d like to benefit from the esoteric expertise and resources that create structures like this—as either an allocator or a capital raiser—read The Shadow Banker’s Secrets: Investment Banking for Alternatives, then schedule your free private consultation.