GP Stakes: How the Financial Class Transfer Their Investment Risk to You and What You Can Do About It

(Originally published by Forbes on November 18, 2022)

The nine most dangerous words in the investment world are: “Did you see what the market did today?”

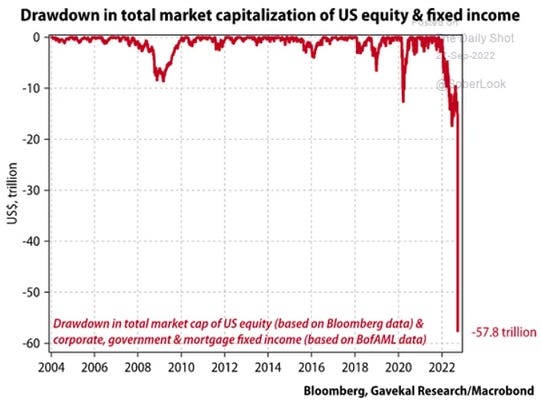

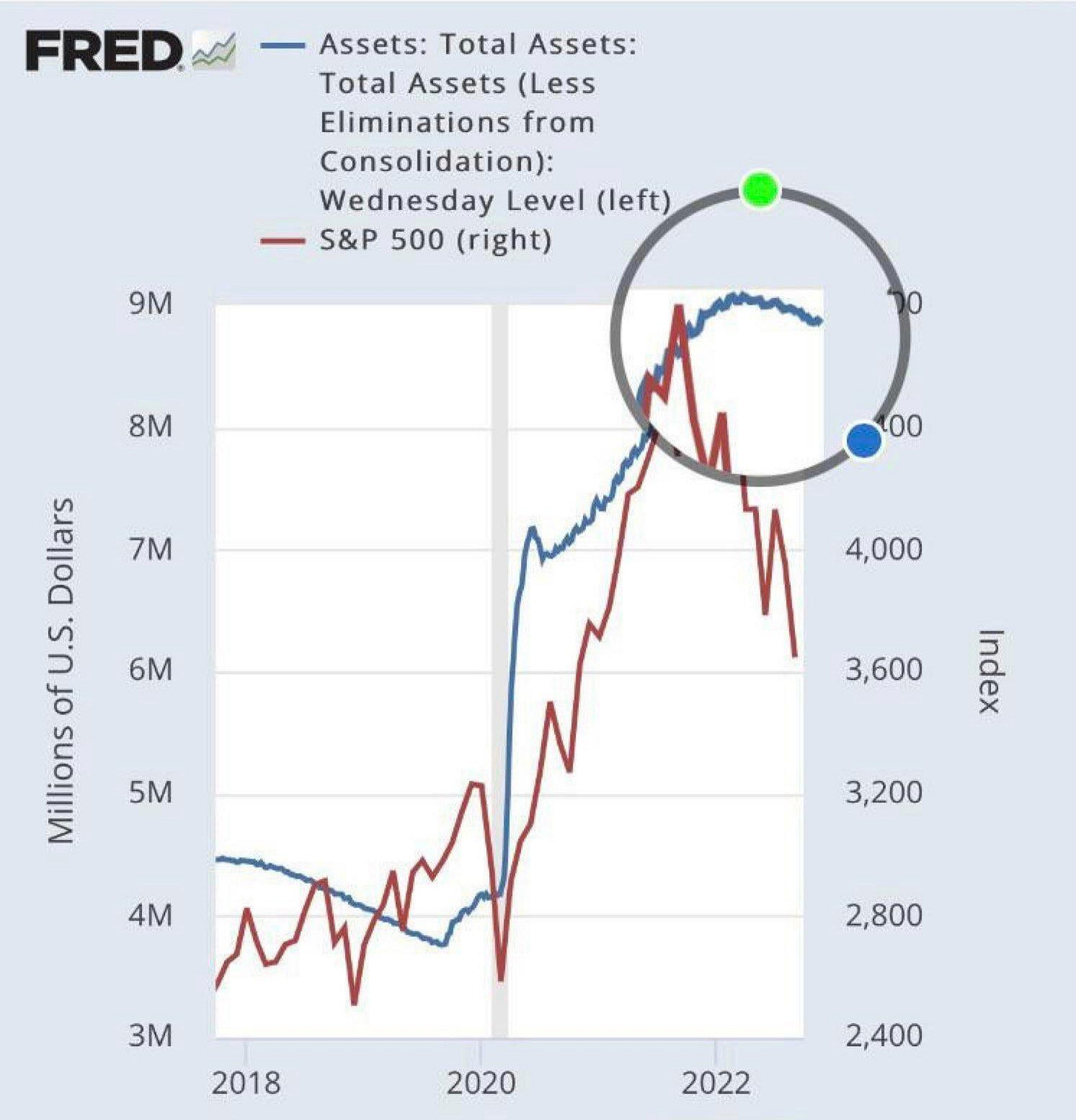

In over two decades of engineering financial products, I have rarely used that phrase, but I’m going there now because as of October 2022, the equity and fixed income markets have lost $58 trillion. This is a raw 1929-style loss scaled across the 21st-century’s globalized market. Unfortunately, it’s only the beginning. For the last decade plus, the Fed has protected capital markets and investors from long-overdue, extremely dramatic market corrections. The Fed has backed itself into a corner between extreme inflationary pressures resulting from its post-2008 interventions and depression that would result from allowing a return to market-driven interest rates.

The Fed has been insolvent on a mark-to-market basis since 2017 and is out of ammunition to “rescue” the world again. You have never seen this play before…

This is not 1980. Because the entire financial system holds incredibly large sums of low-yield fixed-income assets on its balance sheet, the Fed cannot substantially raise and hold interest rates without bankrupting the entire financial system. The Fed’s only move is to make token gestures such as short-lived 75 basis point rate increases that are little more than a bluff, and that’s exactly what it will do until the global tsunami of Fed-induced global market imbalances breaks the dam it created bursting the “everything bubble” devouring your and my investable assets and net worth. With “everything rubble”, the Fed will be forced to capitulate and let inflation run rampant. Welcome to first world’s first global hyper-stagflation scenario.

In the meantime, markets will remain volatile as the smart money positions itself for a crash of epic proportions in 2023. Make no mistake, this is not 2008 redux… the most sophisticated of the smart money learned from what happened the last time and are prepared to get ahead of the imminent, all-encompassing, massive drawdown on the horizon. They’ve focused all their expertise and resources to become the beneficiaries of everyone else’s losses.

They’re not going to achieve this by betting on any one strategy or asset class. They’re going to win with designer financial structures… one you should know but likely don’t: GP stakes.

With in the investible market for GP stakes funds estimated to total about $530 billion this year, access to this level of financial engineering has begun to leak from Blackstone Strategic Capital Partners, Neuberger Berman’s Dyal Capital Partners, Adagio Capital Management, and Goldman Sachs’ Petershill unit. It’s found its way into the portfolios of a handful of super-sophisticated funds of funds and RIAs making GP stakes at least sparingly accessible to the small portion of the accredited investor market with the wherewithal to know where to look and recognize what they see.

In other words, while GP stakes investing is complex and still largely gated, it’s slowly becoming accessible to high net worth retail investors who are smart, curious, and independently minded.

Why all the hushed fuss about GP stakes? This type of structure allows participants to make very high double-digit yields no matter what is happening in the markets, and by its nature GP stakes have very low capacity. Opportunities are rare—even within the institutional space. Access for retail investors will likely always be extremely rare—at best—but invaluable as a financial vehicle; affording performance that is not only uncorrelated, but generates incredibly unmatched absolute risk-adjusted performance. Nothing else comes even close.

To understand the “designer” nature of this opportunity, consider that accredited investors represent about 10 percent of the U.S. population. Qualified purchasers represent about 1.5 percent of the U.S. population—the proverbial top 1 percent. Those who have at least $100 million liquid operate in a completely different world where risk is pushed down to everyone else and sold as unavoidable. This is where GP stakes were born.

So what is GP stakes? The answer to this question begins with understanding the anatomy of private investment funds (i.e., hedge fund, private equity fund, venture capital fund, etc.)

These funds are simply a pool of capital from individual investors that collectively operates as a unified private investment company. The fund manager is often called the GP, or general partner, as a nod to the most common legal fund entity: a limited partnership. The fund manager, or GP, is responsible for investing the fund’s capital and is generally compensated through an agreed upon fee structure that is comprised of a management fee and performance fee. The management fee is paid upfront as a percentage of the total assets under management and the performance fee is paid in arrears as a percentage of the fund’s annual investment gains. A common example of fund manager fee structure is the 2 and 20, which represents a 2 percent performance fee and 20 percent management fee.

If more than one GP manages a fund, each of those GPs are sometimes referred to as a co-GP. If a GP entity has more than one owner, each of those owners can be thought of as a co-GP.

Under certain circumstances, the owner of a fund’s GP might offer specific parties an opportunity to purchase an ownership stake in the GP. This acquiring party is buying into a pro rata percentage of the fees. It’s not unprecedented for one to see 20% to 100%+ annual returns as a co-owner of a GP through a percentage of management and performance fees.

Specific terms associated with individual GP stakes investments are bespoke, and as with any negotiation, result from the nexus of the GP stakes investor’s value-add and asset managers’ respective needs. To be successful, a GP stakes investor must be:

highly adept at the application of quantitative risk analytics to asset manager selections and strategy capacity constraints,

a keen evaluator of operational competency,

a shrewd negotiator of complex deal terms,

an expert navigator of financial firm capital stacks,

and extremely proficient at financial product marketing and distribution—all while ensuring regulatory and legal compliance.

Because these GP investment opportunities are so lucrative, entire funds have been created for the purpose of acquiring equity in GPs. These funds are what the $100 million plus liquid world refers to as GP stakes funds.

As with all private funds, GP stakes funds have a lock-up period that can range anywhere from 24 months to ten years. Of course, if investors have a time horizon of less than 24 months, they should be allocated in money markets, not capital markets.

People often complain about fund managers’ fee structure—especially when markets are down: investors take the hit while fund managers keep getting paid. With GP stakes, fund managers’ fee structures have been engineered into super-exclusive investments that now even smart, curious and independent accredited investors are beginning to access.

To learn how to access designer financial product like GP stakes funds, read #1 international bestseller The Shadow Banker’s Secrets: Investment Banking for Alternatives and schedule your free private consultation.