The Evolution of Data-Driven Investing

From Real Estate Asset Management and Retail Financial Advisory to Financial Engineering Applied to Private Markets

People tend to dislike math…

The human brain evolved to make quick, simple, intuitive judgments to avoid obvious threats such as ravenous predators. There was (and for many people to this day still is) little need for mathematics in survival, and if anything, the intellectual resources required for math would have been a waste of precious energy.

Unfortunately, in finance, risks are not so obvious and require a considered approach to be managed effectively. In fact, they are extremely complicated and require not only a keen qualitative understanding of an investment’s associated business factors but also correspondingly complex math to measure them in a meaningful way.

Computations alone are not enough…

One of the most significant causes of the 2008 financial crisis was not the arithmetic but a poor effort to identify the contributing variables to include in the calculations.

(It’s arguable that these factors were deliberately omitted to maintain the highly profitable game of musical chairs for as long as possible, but that’s another story.)

So, in lieu of math, when most people consider risk, they revert to an intuitive feeling that most often bears little resemblance to reality.

A fairly common example of this phenomenon is the person who is afraid to fly on a commercial plane but has no problem speeding through traffic on a congested highway where the probability of fatality is demonstrably higher. A significant contributing factor to this misestimation is the fact that people tend to believe that their control over a situation reduces risk, when often, especially in financial matters, the opposite is true.

When it comes to investing, people’s desire to reduce perceived risk through direct control is most often expressed through real estate investing, despite the fact that they know little to nothing of investing.

A glaringly ironic example of this paradox is the ultra-high-net-worth individuals who rely on a family office for comprehensive investment and financial services except when it comes to real estate, where they invariably take the DIY approach.

In the fairly rare instances when real estate investors begin to consider risk management, they tend to talk in operational heuristics: reduce risk by buying the worst house in the best neighborhood, using qualified professionals, borrowing on decent terms, etc. While these quasi-solutions begin to address issues that each contribute to the probability of a negative outcome, they fall short, as was made painfully obvious by the colossal losses incurred by investors in 2008 .

And just like pre-2008, lulled into a false sense of confidence by the bull market of the past decade, this round of DIY investors is not prepared for the next crisis that’s likely to occur in the not-so-distant future.

Here’s a specific example of how a typical real estate investor/asset manager thinks about and communicates their expected performance as compared to the accurate method of doing so (if an actual track record for the strategy does not exist across a full market cycle):

The pro forma is predicated on the expectation that the previous years’ market conditions will continue in perpetuity.

The theoretical track record converts the strategy into a comprehensive set of objective rules, then plugs actual historical data into those rules to ascertain how it would have performed against all phases of the market cycle, which is the best indication of how it will perform going forward.

The discrepancy you see here between the pro forma performance and theoretical track record is the exceedingly common scenario. It explains why independent broker-dealers (“IBD”s) are constantly dealing with real estate sponsors that cut distributions.

Granted, it takes a significant amount of effort to research all the data required to comprehensively understand how an investment strategy would have performed across a complete market cycle, but what’s the alternative? Taking a flyer on your and others’ life savings?

On the flip side, the typical financial advisor—while not sophisticated—is indirectly supported by a sophisticated industry. The problem for retail investors is that sophistication is used to benefit the top of the financial industry—not its customers.

There’s typically not even a need to construct a theoretical track record or backtest a traditional portfolio, because they’re typically standard allocations that have actual track records going back for decades.

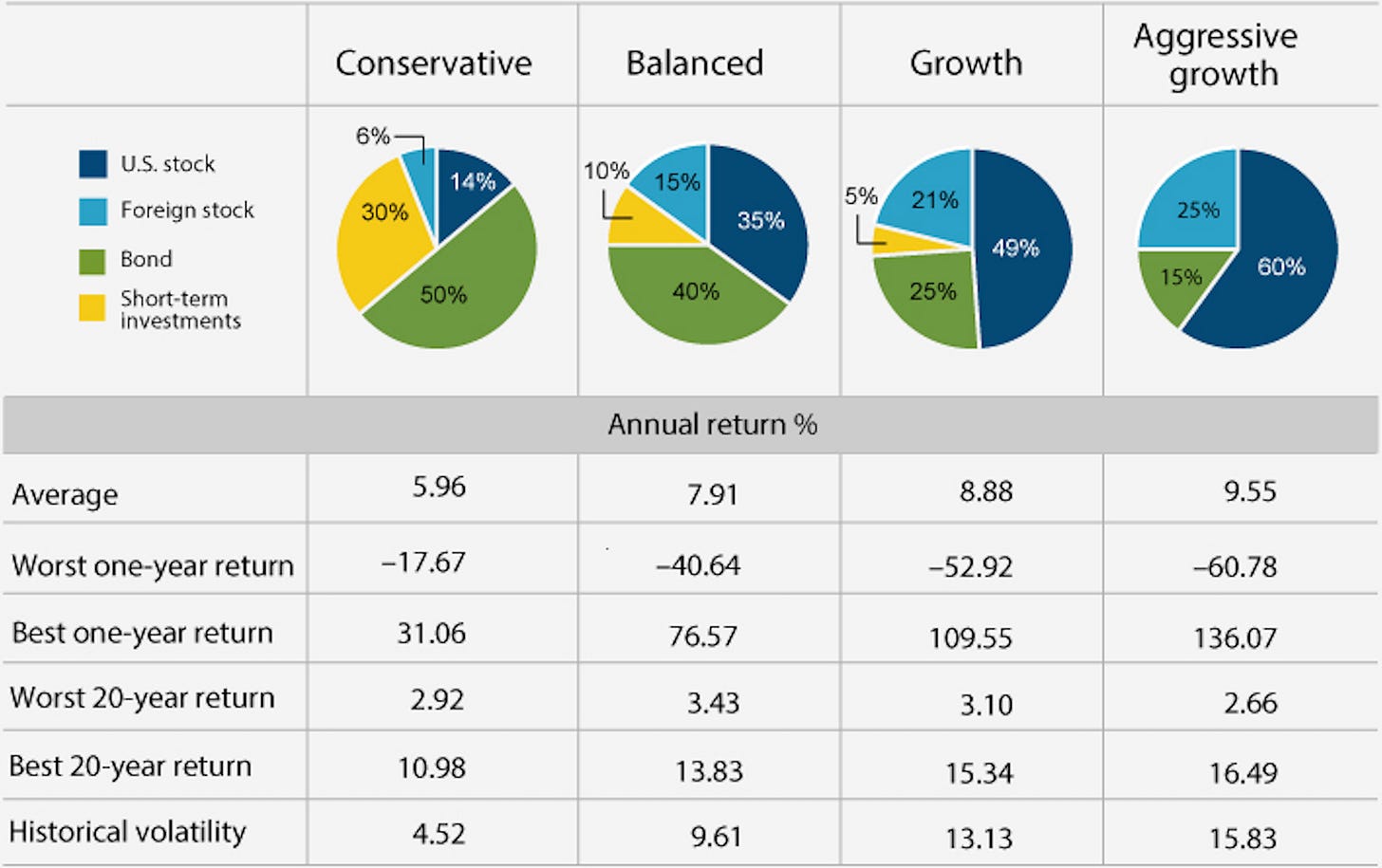

Here’s how these standard allocation models perform and why so many are rightfully disillusioned with traditional financial advisors and pursue DIY investing:

As you can see, the “conservative” portfolio lost almost 20% in its most down year. How can that possibly be deemed safe by any standard? Aggressive growth averages below 10%? You can lend on conservatively valued real estate with a 35% equity cushion and do better than that—without taking a big hit in the down years.

Contrary to what you’ve been indoctrinated to believe, you don’t have to choose between the conservatively administered, poorly performing traditional portfolio and poorly managed high upside potential of private markets.

When the highest levels of financial engineering sophistication are applied to the arbitrage opportunities of private markets, you can get this:

To most people, this appears too good to be true, and for most people it is.

But the financial class—those with at least $100 million liquid—have access to things the public can’t even imagine exist, and that includes financial products with this level of performance.

The mission of Adagio Institute is to educate the public on esoteric financial principles and facilitate unfettered capital markets access for smart, curious, and independently-minded investors (both professional and retail).

We’re hosting an exclusive video conference call on Thursday, October 5th at 6pm EDT to discuss how the level of performance illustrated here is generated and how you can access it. You are invited to actively engage and ask as many substantive questions as you’d like.

To prevent the conversation from digressing into remedial subject matter, all attendees are required to have completed The Shadow Banker’s Secrets: Investment Banking for Alternatives Book or Masterclass. (The book is currently available for free—just cover shipping.) This ensures all participants share a threshold understanding of monetary policy, risk measurement, and investment structure.

You can register for the conference call now, and you have until 4pm EDT, October 5th to complete the book or masterclass. We will be cross-referencing registrants with book order dates and masterclass completions before admitting attendees to the conference call.

We look forward to helping you understand and access the most exclusive private capital market niches…