Which Market Is Better, Real Estate or Stocks?

To start, we’ll define the real estate market by the FTSE NAREIT Index and the stock market by the S&P 500. Here are the annual returns of each looking back across a complete market cycle:

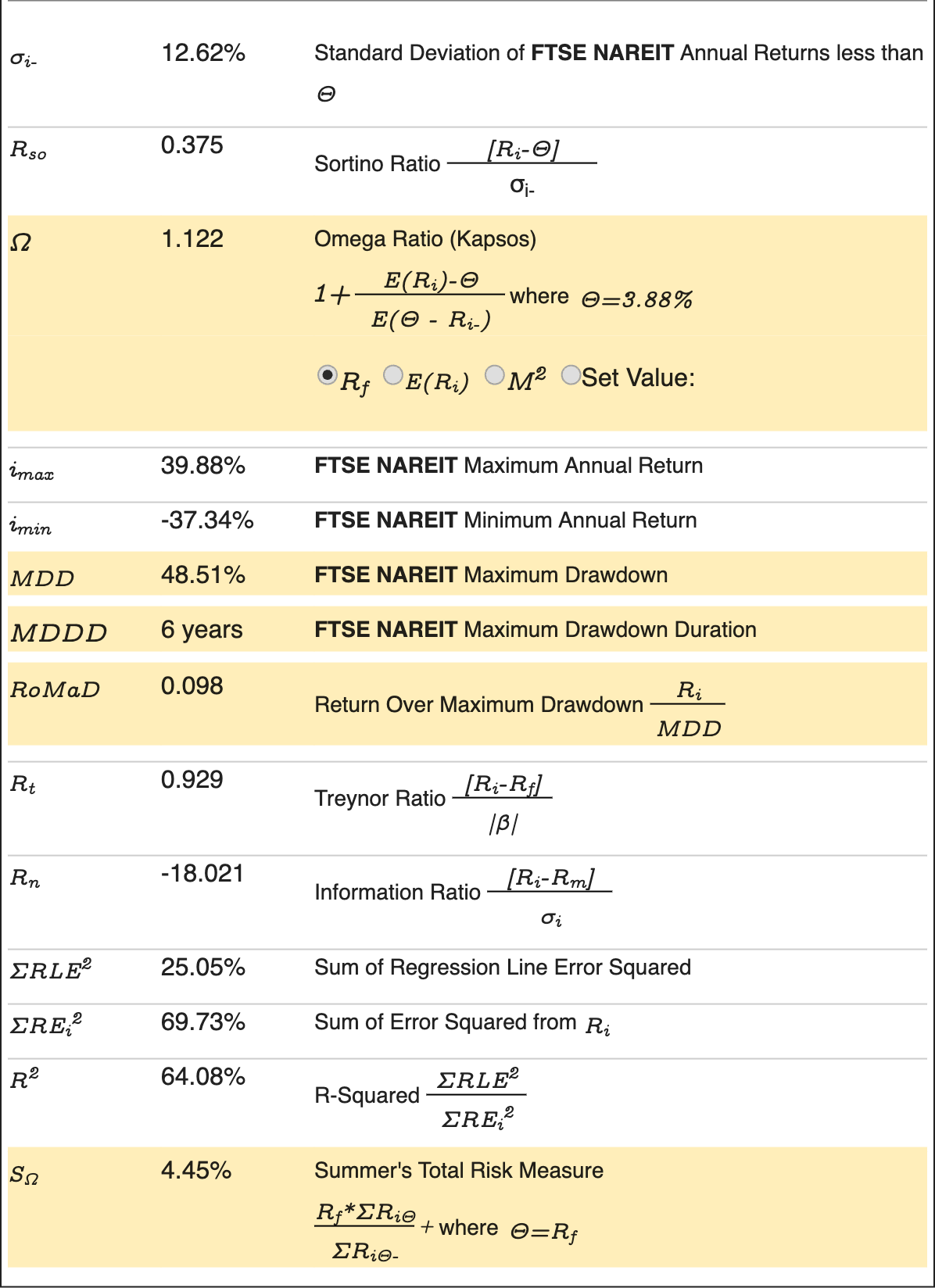

Here are the risk-adjusted performance characteristics of the FTSE NAREIT Index (based upon annual data):

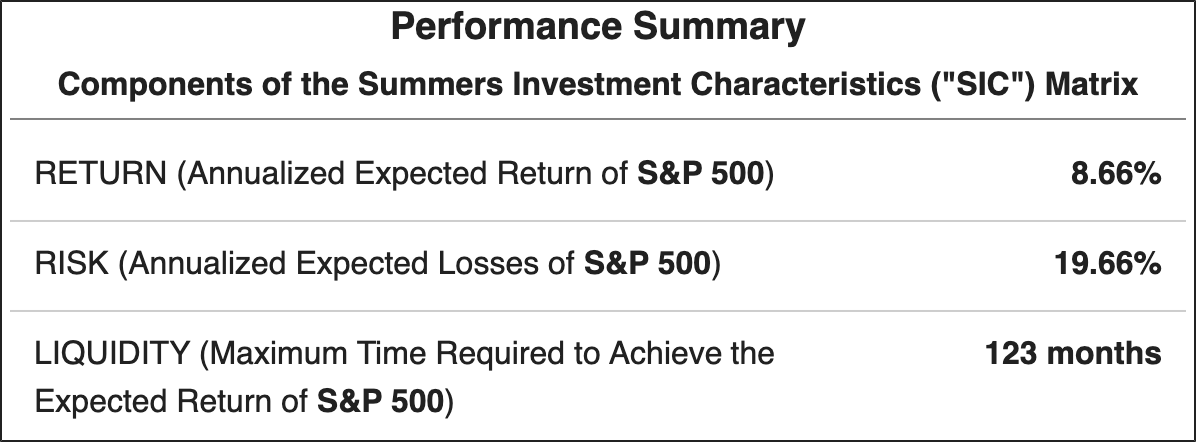

And here are the risk-adjusted performance characteristics of the S&P 500 (based upon annual data for the purpose of an apples-to-apples comparison):

Market-level real estate performance is objectively not great.

The S&P 500—when viewed with higher resolution—is arguably even worse.

That being said, opportunity for sustained investment performance does not exist at the market level—not for any market—it exists in the arbitrage opportunities unique to private markets.

Inefficiencies in capital and information flows within private markets create the opportunity for resource-intensive grass roots mining of arbitrage deal flow, and that’s where the value in markets like real estate and private equity resides.

When private market arbitrage is overlaid with the highest level of financial engineering expertise, you get performance like IIP:

To benefit from the application of financial engineering principles to private markets like the most sophisticated financial institutions, read The Shadow Banker’s Secrets: Investment Banking for Alternatives then schedule your free private consultation.