Bridging the Divide Between Wall Street and Main Street

Our following represents the full spectrum of investors: from high-net worth professionals who DIY real estate or hire financial advisors to the most sophisticated institutions that strategically allocate across asset classes.

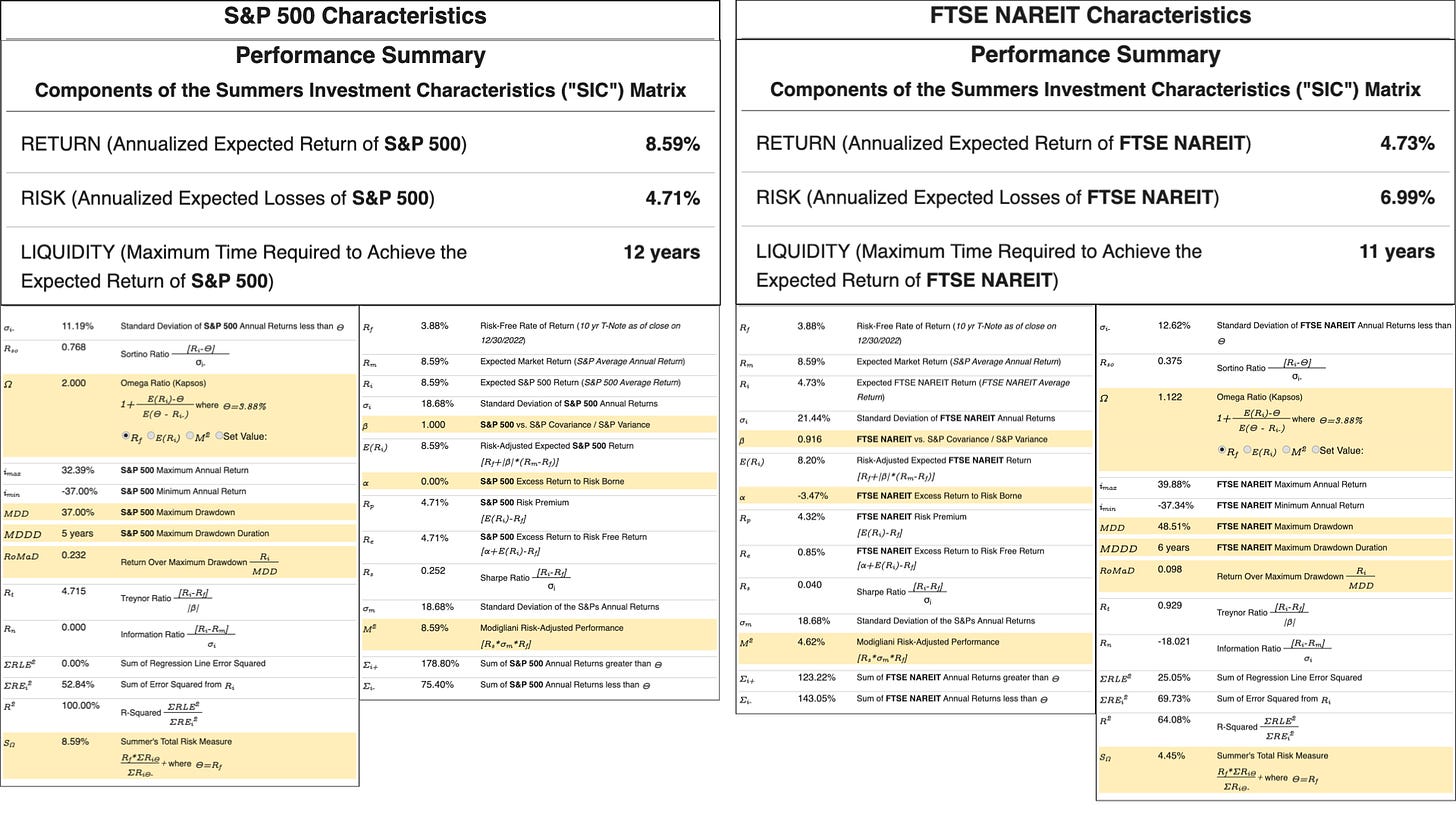

The theme this week has been real estate and stocks in the continued effort to build a bridge between the various camps of our following and eliminate any visceral affinity for a particular asset class in favor of rational analysis.

As we showed, neither market represents a great—or even good—investment. This holds across all asset classes at the market level.

Reliably strong investment performance can only be found in private market arbitrage—capitalizing on inefficiencies in information and capital flows—overlaid with the highest level of financial engineering expertise and institutional operations.

To accomplish this level of performance requires collaboration between ivory tower expertise (financial engineers) and grass roots mining for deal flow (industry experts).

Our mission is to tear down the dogmatic walls of profession-specific cultures in the pursuit of merit… to synthesize the best of all worlds, which is the only means of designing and executing investments with the highest return and lowest measurable risk profile possible.

To accomplish this mission, each role across markets needs to be aware of the potentially valuable contributions that can be made by the others (and their own limitations).

This is why I wrote The Shadow Banker’s Secrets: Investment Banking for Alternatives, built this community, and give away both for free—to create the opportunity for independently-minded investors (both professional and retail) to pursue merit in lieu of indoctrination.

We’d love to speak with you to learn about your individual interests, expertise, resources, challenges, and goals, so that we can provide you the roadmap to reach and exceed your greatest ambitions in the quickest and most efficient way possible.

To get started, read The Shadow Banker’s Secrets: Investment Banking for Alternatives, then schedule your free private consultation.